The initial production scheme, Case A, is designed to produce from three wells with flowlines tied to a central manifold. Onward transmission to the Madimba plant is via a 18” line. This is expected to be supplemented by a further eight wells, Case B, to absorb the remaining plant ullage. Flow assurance has been assessed with no significant issues foreseen.

|

| Madimba Gas Plant |

5.7.1 Case A

The scheme consists of a gathering system of flowlines tied

back to a central manifold which exports the gas via a 33 km x 18” pipeline to

the Madimba gas processing plant which is known to have a current available

ullage of approximately 170 MMscf/d. In the base case peak production is

estimated at just under 40 MMscf/d with the high case at 50 MMscf/d.

Costs for the Case A, including pipeline, are fairly minimal

at about $48 MM. The costs were provided by Ndovu and, on consultation with the

provider, are said to include Indirect Costs (Design Engineering, Project

Management, Insurances, etc.). RPS has allocated a contingency of 25% for

unforeseen growth and possible construction issues. Total capex for the scheme

is $60 MM.

Drilling costs are again provided by Ndovu with 2 existing

wells being re-completed at $4 MM each and one new vertical well at $15 MM. RPS

has included a 15% contingency on these costs to give an overall drilling total

of $26.5 MM.

Operating costs were estimated by the client at

$2.30MM/annum. RPS considers this to be on the low side and has added a small

variable Opex to compensate.

Abandonment costs are included at $9MM representing 7% of

Capex and plugging three wells at $1.5MM each.

5.7.2 Case B

RPS is proposing an ‘Intermediate Development Scheme’, Case

B, whereby further wells could be drilled to take up much of the remainder of

the Madimba plant capacity. It is recognised that the field has further upside

potential which would necessitate a future processing plant upgrade (Madimba)

or a dedicated processing plant located within the field. Export options would

require further examination but there is a possibility of a tie-in to the main

36” trunkline to Dar es Salaam.

Case B will require the drilling of eight additional wells

taking the throughput to 130 MMscf/d. Capex for this scheme has been

extrapolated from Ndovu estimates and assumes the installation of a twin line

to Madimba. Overall Facilities costs are estimated at $150 MM and includes the

EPS. Note that based on other current producing projects, TPDC will likely

build the pipeline.

Drilling costs for the 8 additional wells are $140 MM

including contingency. Operating costs have been increased to $7.50 MM/annum to

accommodate the additional facilities and wells. Abandonment costs are included

at $27 MM for well plugging and land re-instatement.

|

| Chikumbi One Target |

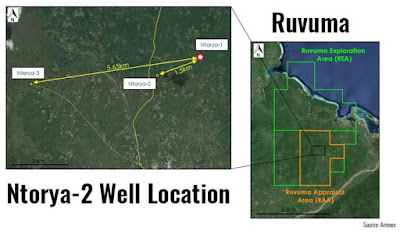

A point recently raised by fear mongers about a raise. The following from the Chairman’s’ letter should allay fears “The carry of up to US$35 million pursuant to the Transaction will allow the acceleration of the development of and production from the Ntorya Field. Moreover, the Board believes that the Group will be able to access cash, including surplus cash flow from future revenues generated by its remaining 25 per cent. interest in the Ruvuma PSA and specifically the Ntorya Field, to continue development of its remaining discovered resource base and will continue to explore and develop the Group’s significant existing prospective resource potential. In addition, the Board believes the Group will be able to fund any long term future development costs for the Ntorya Field beyond the proposed carry amount of US$35 million from its share of future cash flows generated from the field should the need arise.

Full circular document setting out the recently completed Farm-Out terms can be found: Here