Having not posted on the bulletin boards since July 2019 my personal views apart from limited words on Twitter have been pretty much kept to myself.

However I think it's time I should let my own feelings be known once again, but I'll not be doing it on the lunatic asylums known as the bulletin boards.

Therefore my thoughts and views will be placed on the blog and the article links will be tweeted out @AminXunofficial as per usual.Firstly, I'm going to review and update the famous list that the bears love to pick apart. Where time estimates were given, I have added two years to allow for the delays by government in granting it's approvals. It is fairly clear now that those approvals are just around the corner and though frustrated myself like any other true investor. I have never doubted they will come!

The current gas in place figure is 1.87tcf a twelve fold increase in the CPR of 2015

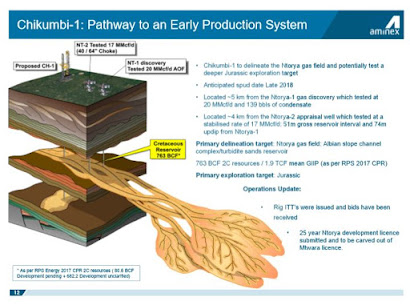

5 TCF GIIP - for Ruvuma - Ntorya 1.9TCF GIIP - 368 BCF 1C - 763 BCF 2C & 1162 BCF 3C

There were significant oil shows at the last drill NT2

Chikumbi 1 is the next drill to be spudded and expected before Qtr1 2021

Farm-Out with Ara Petroleum (APT) to provide Aminex a Full carry worth $140,000,000 include 25% Solo Oil input.

...which includes a committed spending of $40million to Aminex. $5m cash & balance $35million paid as full carry up to 40MMscf/d at which point any unspent remainder will be paid in cash from gas profits.

Negatives

Delay after delay over the approval. These delays are obviously not of the companies choice and though the bears continually blame the board for their own trading deception purposes, they know as well as anyone else, that it is a red tape issue.

The company have completed all that has been required. They have paid a capital gains tax as required and have been fully supported by APT in this, as they have provided a loan to cover the amount.

They have changed the name of the drill at the request of the government from Ntorya to Chikumbi.

The TPDC conducted the required E&H studies, accepted the proposals for the farm-out and sponsored those proposals to the ministry. The government put out the official merger notices to the country 7th August 2019, and an extension licence was granted earlier this year. My view is that the government would not waste its time with all this if it had no intention of granting approval.

Cash position - Not clever, as there is no current income coming through, but a $5m payment from APT plus back costs since agreement are due to be paid on approval. Additionally, there is a significant sum still to be paid for gas already supplied, currently withheld and in dispute due to the companies belief an unjust tax claim. The sums withheld far exceed what is claimed, so whatever the outcome of the dispute the company will still be due a significant seven figure payment once settled. The directors and senior staff have all taken large cuts to their salaries and operational costs have been cut overall. I get the impression keeping the lights on is not an issue and that management are extremely confident of approval coming through anytime in the next few weeks.

It is understood that the Zubair family are extremely supportive of the company and they wish to help the company grow.

Latest accounts 2019